Background

Within three months of assuming office, the president of Ghana, H.E. John Mahama, signed a new law that establishes a state entity, the Ghana Gold Board (Goldbod), as the sole authority with the right to trade, add value to, and export gold. This mandate applies specifically to the artisanal and small-scale gold mining (ASGM) sector.

The nation’s new leadership believes that taking over the post-mining gold sector is necessary to streamline and maximize national benefits from the nation’s ASGM industry. The speed at which the government passed this new legislation reveals the sector’s pivotal role in the administration’s agenda of currency stabilization and foreign reserves accumulation.

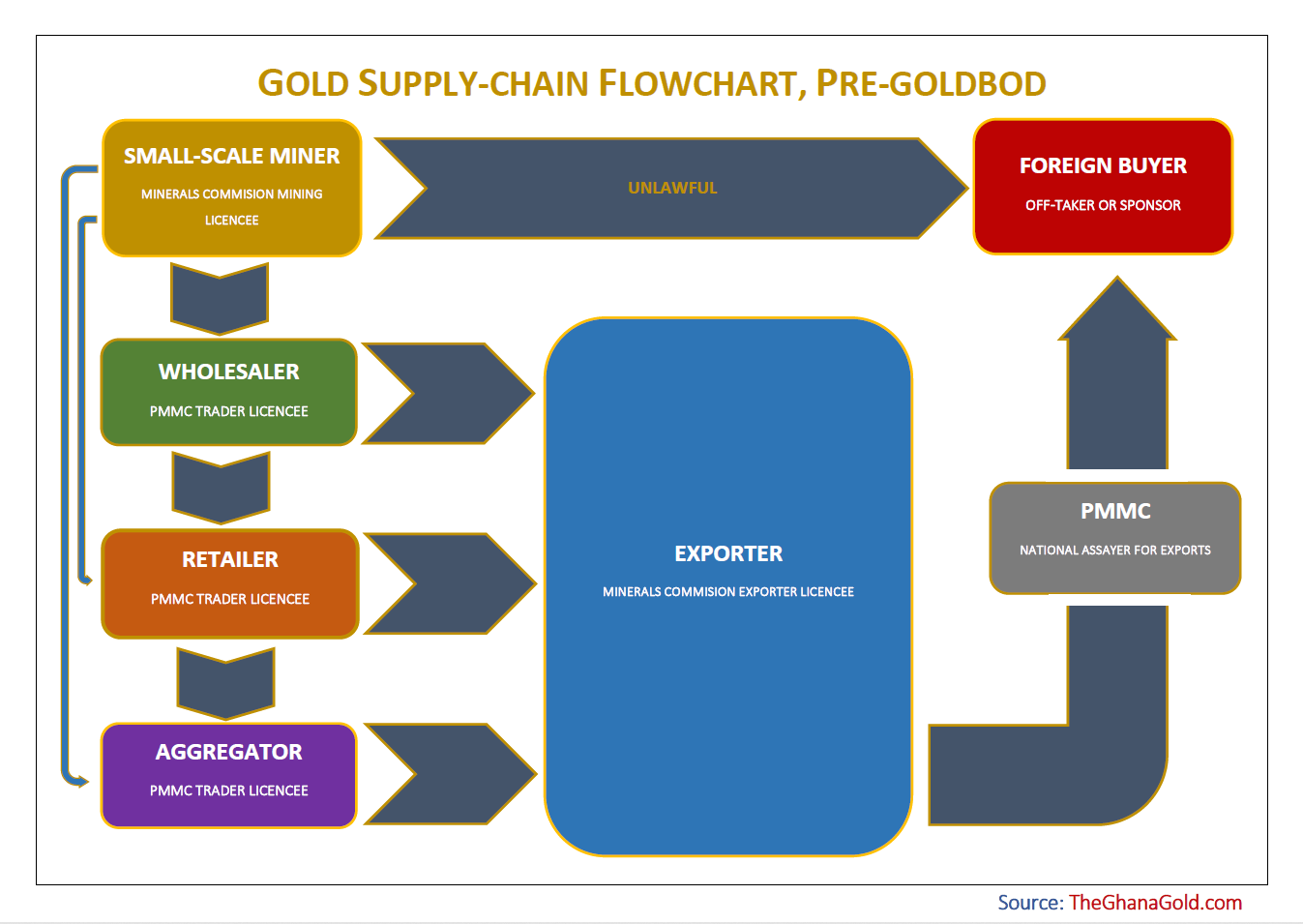

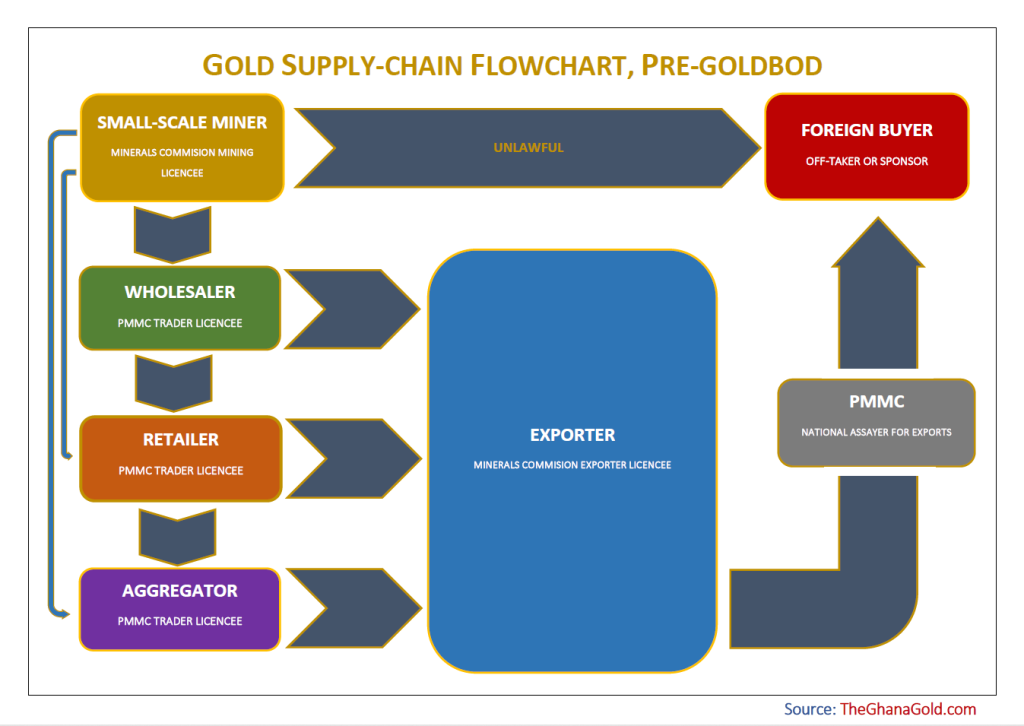

Pre-Goldbod Supply Flow

Before the passage of the Ghana Goldbod Act (1140), 2025, the local gold supply chain was dominated by private businesses — licensed private gold traders and exporters. On the surface, the supply flow of gold from the local miner to the foreign buyer does not appear to have changed much, especially since the Goldbod is to carry out its mandates through licensed private entities. This is not the case.

A closer look would reveal that the gold supply structure introduced by the Goldbod is markedly different. Highlighted here are some key changes occasioned by the Goldbod and the implications of these policy changes for industry stakeholders. This was the local supply chain before the Ghana Gold Board Act was introduced:

Wholesalers

Gold sourced from small-scale mines was procured mainly by local gold traders (wholesalers) who set up trading hubs close to mining sites to buy gold directly from miners as often as possible. Trading hubs process gold nuggets for easier assaying, valuing, and transporting. These local wholesalers accumulate gold from different miners and sell it to retail traders who frequent these mining areas to procure gold doré. Another category of gold buyers who procure gold from miners and wholesalers is jewelry-makers.

Some retailers skip over wholesalers and establish direct contact with miners to procure gold at better rates. The disadvantage of going the direct route is that retailers would likely not immediately obtain the quantity they may require from a single miner. This is where wholesalers have an advantage. Wholesalers usually have larger quantities since they aggregate gold from different miners. Some wholesalers release the wares accumulated throughout the week only on Tuesdays. Tuesdays are an unofficial market day for gold buying across many gold mining hubs in Ghana.

Retailers

Local gold retailers transport gold doré to the bigger gold trading hubs like Kumasi and Accra, where they retail their gold, often at a markup of between 0.2% and 0.7%, to other retailers, exporters, or foreign buyers. Sometimes, the same entity that sets up a trading hub in a mining area would also transport doré to the cities to retail. Such a business set up is more profitable since it by-passes the middleman and sells doré for a bigger profit in the metropolis.

A larger percentage of gold retailers’ clients are foreigners. Primarily because they usually have more capital. Given the high-risk nature of international gold trading, foreign buyers choose to travel to Ghana to procure gold doré in person, after which they engage the services of a licensed gold exporter to handle the export process to their home country. Over time, these foreigners may establish trust with local gold traders and exporters. Once they do, they can afford to return home and delegate the local procurement and logistics processes to these local partners.

Exporters

Licensed gold exporters usually do not engage directly in local gold trade unless they have a gold trading license as well. The scope of an export licence does not cover local gold trade. Its mandate is limited to selling to buyers abroad and arranging the logistics and shipping. A foreign buyer in Ghana or abroad would require the services of an exporter to ship the gold home. A local gold trader who has secured the trust of a foreign off-taker to supply doré would also require the services of a licensed exporter.

A buyer would require the gold to be assayed, weighed, and valued. Therefore, most exporters also offer these services to properly determine the purchase price and record accurate details for export declaration purposes. The national assayer, the Precious Minerals Marketing Company (PMMC), assays all gold before export to confirm the accuracy of the records provided by the exporter. This would also help determine the export tax due, since export taxes are calculated as a percentage of gold value. The export tax was adjusted downwards from 3% to 1.5% in 2022. It remained at this level till the establishment of the Goldbod.

Foreign Off-takers

A bulk of the gold extracted locally is exported overseas — over 95%. The gold that remains within the country is primarily used for jewelry. The global gold market is so competitive that many foreign off-takers are willing to pre-finance the procurement of gold. Two criteria that experienced pre-financing off-takers first establish with their suppliers are trust and capacity. Many local traders may meet the criterion of trust. Capacity is usually more difficult to prove before the first transaction, as most gold wholesalers and retailers do not keep records of their trade activities. Eventually, a third type of local trader emerged to fill this gap, ie, aggregators.

Aggregators

Aggregators operate with the same licence as retailers and wholesalers —the PMMC-issued gold trader (or gold dealer) licence. Aggregators operate at another level of wholesale trading between the retailer and the exporter. Sophisticated and connected businessmen and businesswomen who saw the opportunity quickly signed up as aggregators, while some retailers and wholesalers who had the capacity upgraded their establishments to meet the standard.

Aggregators source gold from across the supply chain; retailers, wholesalers, and miners. Aggregators typically find foreign off-takers and engage licensed exporters to handle the export-related side of the business. Major aggregators set up the structures necessary to demonstrate the ability to supply the required quantities of gold regularly. Many off-takers are glad to work with an aggregator as long as they can supply the goods and demonstrate trust.

Pre-financing Off-takers

Major-league foreign off-takers willing to front millions of United States Dollars per order sometimes look out for certain markers to confirm capacity or trust. Many of them look out for these characteristics to screen out potential fraudsters: basic command of the English language, company registration, ability to issue invoices, receipts, and ancillary documents and reports, for example. Even with these, many off-takers would first test a supplier with small orders before committing.

In the pre-Goldbod regime, aggregators and exporters were at the center of local gold trade. The ones who controlled the money controlled the game. Though many had financiers from overseas, aggregators and exporters controlled the money on the local market, so influence gravitated towards them. Aggregators and exporters often pre-financed miners, wholesalers, and retailers to ensure ample and regular gold supplies. Such pre-financing arrangements often came with a condition of supplying gold at a discount.

Political Disruption

As time passed, politically active persons entered and eventually dominated the local gold market, mostly as exporters and aggregators. To expand the gold supply from the mines, these politically active persons secured small-scale mining concessions so they could vertically integrate their operations and maximize their supply capacities. For this reason, there was an influx of mining leases granted by the mining sector regulator — the Minerals Commission (MinComm). Many of these actors exerted their influence so successfully that it appeared they had unofficial arrangements with top-level state actors to bend and even change laws to suit their business interests to the detriment of the environment, the public purse, and ultimately the economy.

This order prevailed until there was a change of government in January 2025. Within five months of assuming office, the new government set up a state institution backed by law to regulate and coordinate the post-mining activities of the ASGM sector— the Ghana Gold Board (Goldbod). To learn about the major policy shifts introduced by the Goldbod, read Gold Supply Flowchart: Part 2 – Under Goldbod.