Gold has long been considered a global currency serving as a common language of exchange between countries. Today, this shiny metal continues to play a very central role around the world. As a store of value, a hedge against inflation and deflation, or as a diversification tool for investors, gold has established itself as a multifaceted financial asset.

An introduction to gold

“The desire of gold is not for gold. It is for the means of freedom and benefit“.

— Ralph Waldo Emerson

What is gold?

Gold is a rare physical commodity. While it is indestructible and difficult to extract, it is also extremely malleable. Thanks to its high density, it is an easy metal to store and transport relative to others. All these characteristics make it a unique metal and a highly sought-after investment product. Gold’s long-term price stability and its historical role as a safe haven and store of value, have given it a distinct advantage in the eye of many investors over a large number of other investment assets.

The origins of gold

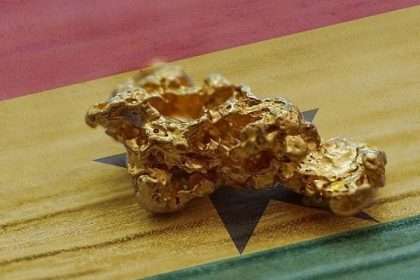

Gold has been one of man’s most precious commodities for thousands of years. So much so in fact, that some civilizations even attributed it with divine properties associated with their solar deities. It was first found in the form of nuggets at the bottom of rivers around the world, and was thus one of the first metals to be used by our ancestors. But in its raw nugget form, gold was still quite difficult to work and use.

Gold in history

The first traces of man-made smelted gold date back to 5600 years ago. It was probably the Egyptians who first succeeded in mastering the yellow metal and made it a symbol of wealth as well as royal and religious power. It was only much later that the first gold coins finally appeared. The first coins containing gold date back to about 600 BC, initially made of a mixture of gold and other metals, they later became pure gold coins.

The advent of gold

This new use as a currency truly heralded the beginning of a new era for the metal and gold quickly began serving as a basis for a large number of currencies around the world. Taken by this new means of exchange, societies gradually moved away from barter systems toward currencies based mostly on gold, which gave them an intrinsic value. Later on, scientific knowledge of precious metals continued to improve, with the development of refining and of increasingly accurate measurement systems.

However, as centuries past, paper money, also known as fiat currency, gradually took gold’s central place in the world trade. And finally, in the middle of the 20th century, the end of the gold standard and of the Bretton Woods agreement marked the end of gold as the basis for most major currencies.

But what may have seemed like a death knell for the precious metal, actually allowed it to fully enter its current role as an investment vehicle. Building on its unique properties, its history as a store of value, and its historical stability, gold found a way to reinvent itself and became a sought-after commodity in many leading industries as well as an essential asset for any modern investment portfolio.

Who are the actors in the gold industry?

To better understand the elements making up the price of gold, we need to start by looking at the actors of its industry.

Most of the world’s gold is produced by a small number of countries: China, South Africa, the United States, Australia, Russia, Canada, Brazil, or Indonesia. After being mined, it then continues its journey through what is known as the gold supply chain.

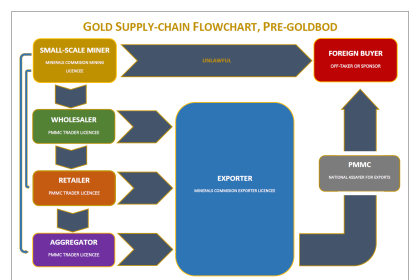

This supply chain is made up of every step between mining and the final consumer product (smartphone, solar panel, etc.) or investment product (bar, coin, etc.). Gold recycling is also an integral part of the metal’s supply chain, with jewelry, coins, and industrial products containing gold (computers, smartphones, etc.) being recovered and sent to refineries where, once recycled, the gold they contained will be reintegrated into the chain.

Here is a graphic that will allow you to better visualize all these steps:

Who buys gold?

Gold is a rare and prized material around the world. It is sought after in manufacturing for its unique properties, in jewelry for its precious history, beauty, and malleability, and as an investment for its role as a store of value and source of diversification. In addition to these three main players in the demand for gold, central banks also account for a significant portion of global purchases.

The world demand for gold is therefore divided into four main sectors:

- Jewelry: while it represents about 50% of the world demand, its share has been shrinking over the years.

- Investment: This is the demand sector experiencing the greatest growth, with a 235% increase in the last 30 years of the annual volume of gold purchased by investors.

- Central banks: International central banks have made up an increasingly important part of the demand in recent years.

- Manufacturing: Gold is used in many innovative industries: Nanotechnologies, engineering, environment, solar, etc.

The demand for each sector tends to evolve from one year to another depending on technological developments or major local and global economic trends.

While demand for jewelry still accounts for 50% of global gold demand, its share has been declining over the past ten years. Investment demand, on the other hand, has increased by an average of 15% per year since 2001. This trend has been encouraged by the arrival of a growing number of countries on the open market and by the development of new forms of gold-related investments such as ETFs (exchange-traded funds).

The search by private investors for good risk management and better diversification of their investment portfolios has also played a role in this growing investment interest for gold.

Gold Lesson 2 – All About Physical Gold