Introduction

The Ghana Gold Board can improve their licensing regime by a long shot to optimize for utility and minimalism. The licensing regime under the Ghana Gold Board Act 2025, is complex, jam-packed, and inexhaustive. There are ways of organizing the number, scope and names of licensing to be simple, comprehensive and fit-for-purpose.

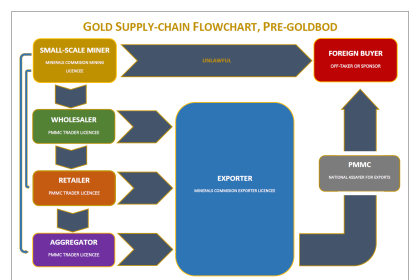

Previous Licencing Regime

Before introducing the Ghana Gold Board Act (Act 1140), 2025, existing legislation provided for the issuance of the following four licences in relation to the local gold supply chain;

- Gold Dealers Licence

- Gold Refinery Licence

- Export Licence

- Export Licence for Holders of Mineral Rights

The two Export Licences were issued by the Ghana Minerals Commission (MinComm), while the Gold Dealers and Refinery Licences are issued by the Precious Minerals Marketing Company (PMMC), which has been transformed into the Ghana Gold Board (Goldbod).

Both export licences issued by MinComm permitted licencees to purchase gold locally, process gold, smelt gold, and export gold on the international market. The export licence variation for mineral rights holders grants extended autonomous permissions to large-scale mining companies. For instance, large-scale miners are not required to assay their gold with the national assayer—PMMC prior to exporting gold, as is required for their small-scale counterparts.

The PMMC-issued Gold Dealers’ Licence permits licencees to buy gold locally, process gold, smelt gold, assay gold, store gold, and sell gold locally. The Refinery Licence grants the right to process, smelt, refine, and assay gold. Some of the rights overlap across licences. The licencing regime can be better rationalized for a more streamlined sector.

Goldbod Licence Regime

Since the inauguration of the technical committee of the Ghana Gold Board popularly referred to as GOLDBOD in late January, 2025, some draft iterations of the proposed ‘GOLDBOD Bill’ has been made available to industry stakeholders.

The Gold Board Act, 2025 states the following ten as Licences issuable under the Goldbod:

- Aggregation Licence

- Buying Licence

- Refining Licence

- Export Partnership Licence

- Storage Licence

- Importation Licence

- Transhipment Licence

- Transportation Licence

- Fabrication Licence

Related to the above listed licences, a longer list was presented in the draft as comprising “the business or related activity in the gold trading and marketing industry”, namely – aggregation, buying, selling, trading, assaying, refining, processing, storage, transportation, importation, exportation, transhipment, transit, and shipment.

The GOLDBOD proposes ten licences, and lists fourteen sector-related activities. Clearly, the proponents decided to merge some activities under a single licence. However, ten Licences can be further reduced, and more importantly, better merged. It would be rather unfortunate if the motivation for creating a myriad licences were to have the issuance of a plethora of licences as a revenue generation strategy for the board. We would like to believe this is not the case.

Proposed Licences

The many activities that comprise the post-mining gold value chain can be categorized into four major areas:

- Trading—wholesale (aggregating and selling), retail (buying and selling), importation, exportation, temporal import re-export.

- Value-addition—processing, smelting, refining, assaying, fabrication (jewellery-making, electronics and chip-making, etc).

- Storage—storage services, private ownership.

- Transportation—local transportation (courier services), international transportation (shipping), transit, transhipment.

Based on these categorizations, GOLDBOD can issue exactly two licence categories in each of the four areas and cover all the essential activities across the entire value chain with a total number of eight (8) licences. These eight licences would even cover certain essential areas not covered by the licences proposed in the Goldbod Act, such as gold ownership. These eight licences are as follows:

- Local Gold Trader Licence

- International Bullion Trader Licence

- Gold Refinery Licence

- Gold Fabrication Licence

- Bullion Storage Licence

- Private Bullion Ownership Licence

- Bullion Courier Licence

- Bullion Shipping Licence

Let us go ahead and detail the ambit or coverage of each of these Licences.

Proposed Licences Explained

Local Gold Trader Licence: Local aggregation(buying from local mining companies, selling to local buyers), local retail—buying(buying from local aggregators), local retail—selling(selling to local buyers), temporary storage, smelting, spot assaying.

International Bullion Trader Licence: local retail—buying(buying from local aggregators or retailers only—never directly from local mining companies), international retail—import(buying from sellers abroad), International retail—export(selling to buyers abroad), temporal import re-export(buying from sellers abroad to sell to buyers abroad), temporary storage, smelting, spot assaying.

Gold Refinery Licence: Processing, smelting, refining, assaying, temporary storage.

Gold Fabrication Licence: Processing, smelting, refining, fabrication, assaying, temporary storage.

Bullion Storage Licence: Vault storage services—primarily on behalf of clients.

Private Bullion Ownership Licence: Private storage (with a minimum duration of ownership), local retail—buying (buying from local aggregators or retailers—never from miners), International retail—import (buying from sellers abroad), local retail—selling (selling to local buyers), International retail—export (selling to buyers abroad).

Bullion Courier Licence: local transportation (under strict security protocols).

Bullion Shipping Licence: Global shipping—cross-border transportation by sea, air and land, transiting (does not involve a change in vessel, craft, or vehicle), transshipping (involves a change in vessel, craft, or vehicle).

Definition of Terms

Temporary storage: ‘Temporary storage’ shall not exceed eight (8) weeks. If the activities of any licenced entity (except a Private Bullion Ownership Licence holder) requires that consignments of gold be stored for a period exceeding two (2) months on a regular basis, it is necessary that they would be required to acquire a Bullion Storage Licence as well. The licensing authority ought to introduce a ‘storage extension permit’, issuable to entities when they need to keep products beyond eight weeks on rare occasions.

Minimum Ownership Duration: There is the tendency or temptation for a private bullion ownership licencee to engage in gold retail using their licence; ie, buying gold and flipping it for a profit on a regular basis. To plug this gap, there is the need to indicate in the scope of the licence a minimum duration which gold acquired under the Private Bullion Ownership Licence shall have to be stored or owned before it can be resold. The proposed minimum duration is twelve weeks (three months).

Smelting: Local and international traders need automatic permission for gold processing and smelting. The reason is that the physical form rof aw gold is often in nuggets or gold ore. It is not ideal to trade large amounts of gold in several small nuggets, as each nugget is likely to differ in composition and purity level, and as such, would make the process of valuing difficult. Some preliminary processing and smelting is necessary to get rid of impurities in gold ore, and have the gold nuggets in a more suitable form, smelted and congealed for easy assaying and valuing.

Spot Assaying: Both local and international traders are required to assay gold to determine purity levels and mineral composition at the point of trade as a prelude to determining the purchase price — valuing. ‘Spot’ is used here to differentiate between assaying at the point of trade from assaying at the point of export. The latter is the reserve of the state according to Ghanaian law. For instance, the exclusive right of the erstwhile PMMC as the National Assayer was most practical before exports, in particular, as a value verification measure of gold leaving the jurisdiction. This national assayer role has since passed to the Goldbod. It would not be practical to limit assaying to the time of export, as it is essential to proper valuing in local trade transactions as well.

Export and Import: The terms export and import can be applied in two contexts. First is in the context of international transportation, where imports and exports are activities carried out by shipping companies; shipping goods into (import) or out of (export) a geographical jurisdiction. The second application is in the context of international trade, where traders import by procuring goods from suppliers outside their country, and export by selling to buyers abroad. The terms as used in this document refer to the latter context of international trade, while the former context is captured in the write-up with the term ‘shipping’.

Transiting and Transshipping: Both transiting and transshipping involve goods moving from one country, going through a temporary stopover in another country, usually for the vessel to drop off some goods and also carry more goods, before moving on to the final destination country. Goods are said to have gone through transshipping when, during the stopover, the goods are transferred from the original vessel, craft or vehicle to a different one. The new vessel carries the goods onward to the final destination country.

Goods in transit, on the other hand, do not involve transferring goods to a different vessel or craft; the same vessel carries the goods in question to the final destination after the stopover. Since the exporter of the goods is in the country of origin and the consignee (final receiver) is at the final point of discharge, no third party has any contact whatsoever with the goods at the transit point. For this reason, transits and transshipping and their respective Licences are solely the responsibility of shipping companies, not bullion exporters or importers.

Temporal import re-export: With temporal import re-export, however, the goods do not just undergo a stopover. The consignee (receiver) receives the product in the country where the goods stopover. However, the intention is that the goods would eventually be exported—either back to the country of origin or to a different country altogether. A classic example of a situation where temporal import re-export rights come into play is where a local refinery procures raw gold (gold doré) from abroad to refine it, and after that, re-exports it to a foreign buyer. Licensing that grants import re-export rights affords the Licencee privileges such as a duties exemption or a duties discount on the gold import, since it is not imported for local use or storage, but for eventual re-export.

Jewellery: After jewellery has been fabricated from gold doré, it ceases to be gold bullion. It becomes an ornament. As such, the laws and regulations applicable to bullion should not apply thenceforth. An entirely different body of legislation should be introduced to regulate the jewellery industry, including its storage and transportation.

Export Partnership License

An essential licence to examine in more detail is the ‘Export Partnership Licence’ as proposed in the Goldbod Act. The ‘Export Partnership Licence’ is defined in the document as follows; “a licence granted to an entity or individual that partners with the Goldbod to export gold in compliance with national and international regulations”. In the light of this definition, this licence ought to simply be called ‘Export Licence’. The word ‘Partnership’ is redundant and unnecessary. And this is the reason for this assertion.

Under Functions of the Goldbod—Section 3— e), f) and h) in the draft bill, GOLDBOD is named the “exclusive authority to grade, assay, value… purchase, sell… [and] export [emphasis added] gold sourced from [small scale mining]”. A subsequent section of the bill lists the Licences Goldbod shall issue to external parties for the execution of these very activities early on stated as exclusive mandates of the Goldbod.

There is no alternative interpretation but to assume that Goldbod shall through licencing enlist the partnership of qualified agents and agencies, ie, private sector industry players in the carrying out of the above-listed mandates. It is therefore strange that after listing licences in the various areas where the Goldbod has exclusive authority, the area of export in particular is singled out for emphasis by attaching the word ‘partnership’. All Licencees are Goldbod partners.

If there are intended operational variations with different calibres of exporters, it would be more prudent to issue one export licence, but with variations which should be spelt out in the scope of each type of licence. For instance, there could be a ‘Grade A Export Licence’ and a ‘Grade B Export Licence’ with differences in the scope of operationalization.

Conclusion

One would notice that, the word ‘gold’ is replaced with ‘bullion’ in some of the proposed licences. This is not a coincidence. It would serve some advantage to limit the activities of those licencees who have ‘bullion’ rather than ‘gold’ to involve smelted or semi-refined gold, ie, gold doré. Also known as gold bullion. Gold nuggets and other forms of unprocessed or ‘raw’ gold would be better off limited to those licencees whose activities necessitate obtaining gold directly from miners, either for sale or for value addition, ie, local gold traders, fabricators, and refineries.

To end with, combining the activities of gold retailers and gold exporters in the International Bullion Trader Licence, and the activities of gold retailers and gold aggregators in the Local Gold Trader Licence, is a more accurate reflection of how certain value-chain activities run together. This model would enhance synergy across the gold value chain, as well as provide a structure for easier management, enhanced accountability and traceability.